Financing, growth, jobs… How is French tech faring in the first half of 2023?

Economic outlook 2023, net job creation 2022… The French digital market is doing well

Internationally, the recent layoff plans and bank failures have changed the outlook for tech, already impacted by falling valuations and the slowdown in private financing. However, the real economy of French tech does not seem to be confirming these trends, which are more marked in the USA and Germany.

It’s a fact. French Tech financing is slowing down. At the end of June 2023, French start-ups had raised 4.1 billion euros in 448 deals. This is half the figure for the same period in 2022, when they raised 8.4 billion euros via 362 deals. But will this have an impact on business and employment?

6.3% growth forecast for the French digital sector in 2023

Compared to 2022, the French digital market is also experiencing a slight slowdown, with 6.3% growth forecast (versus 7.2% in 2022). However, this contraction needs to be put into perspective , as 2022 was an exceptional year, and growth in the digital sector remains more dynamic than overall economic growth (0.7% forecast for 2023, according to the Banque de France), for a market worth 65 billion euros. It should also be noted that the top 3 customer sectors remain the same as in 2022, led by industry (30% market share), banking and insurance (15.3%) and services (14.8%).

One in six jobs created in France by 2022 will be in the digital sector

Even if the talent shortage remains the major challenge, our sector has created over 47,000 jobs in France by 2022. That’s around one in six net new jobs created in the digital sector last year. This makes 2022 the sector’s 13th consecutive year of job creation.(Source: Numeum, semi-annual study on 2023 economic indicators for the digital sector, June 27, 2023).

Resilience and dynamism for employment in French Tech startups in the first half of 2023

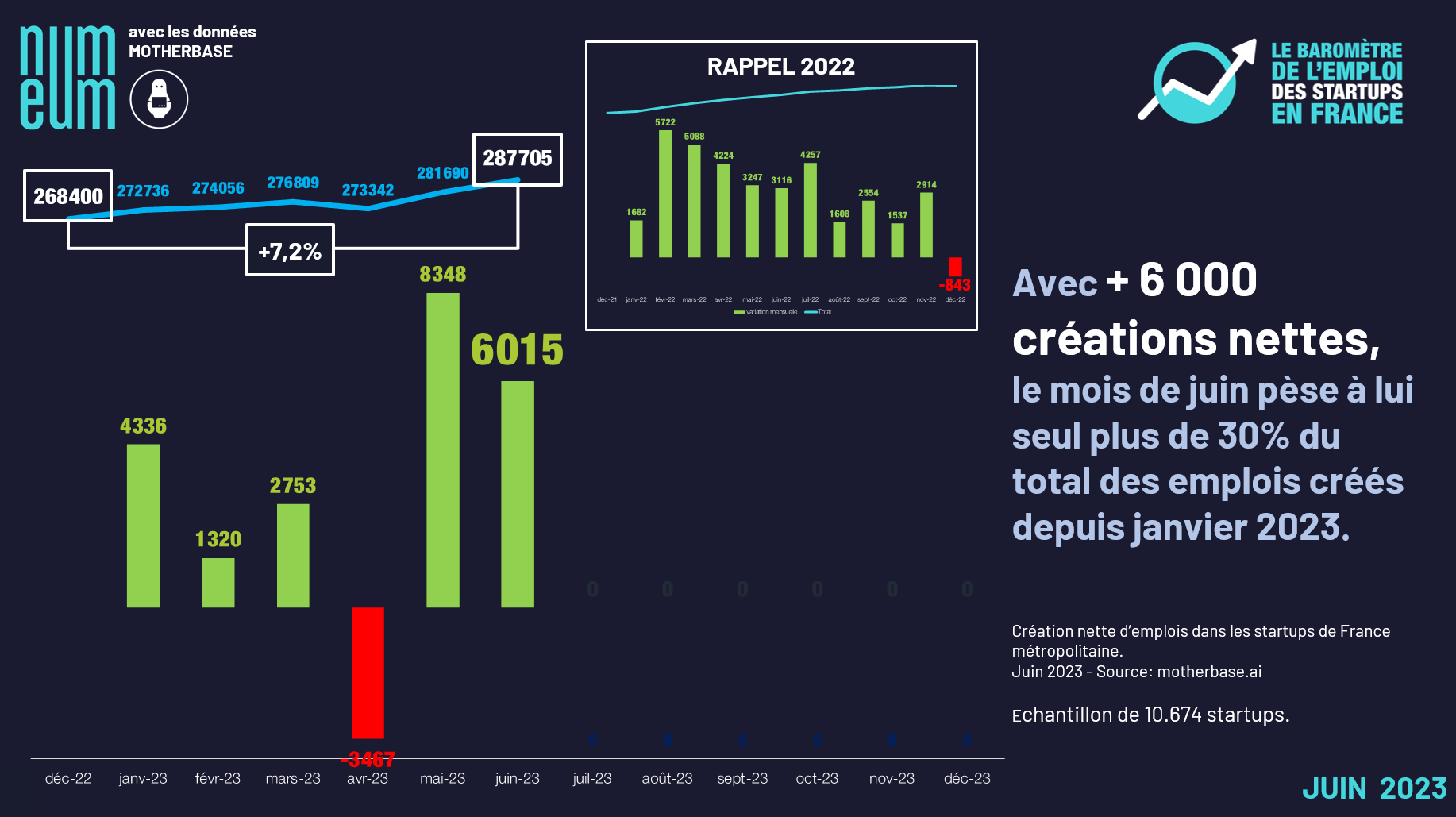

If we now take a closer look at employment in French startups*, the trends for the first half of the year are similar. Although 2023 is off to a less impressive start than 2022, the first half of the year remains a very good vintage.

French Tech nuggets have created more than 19,000 jobs since January 2023.

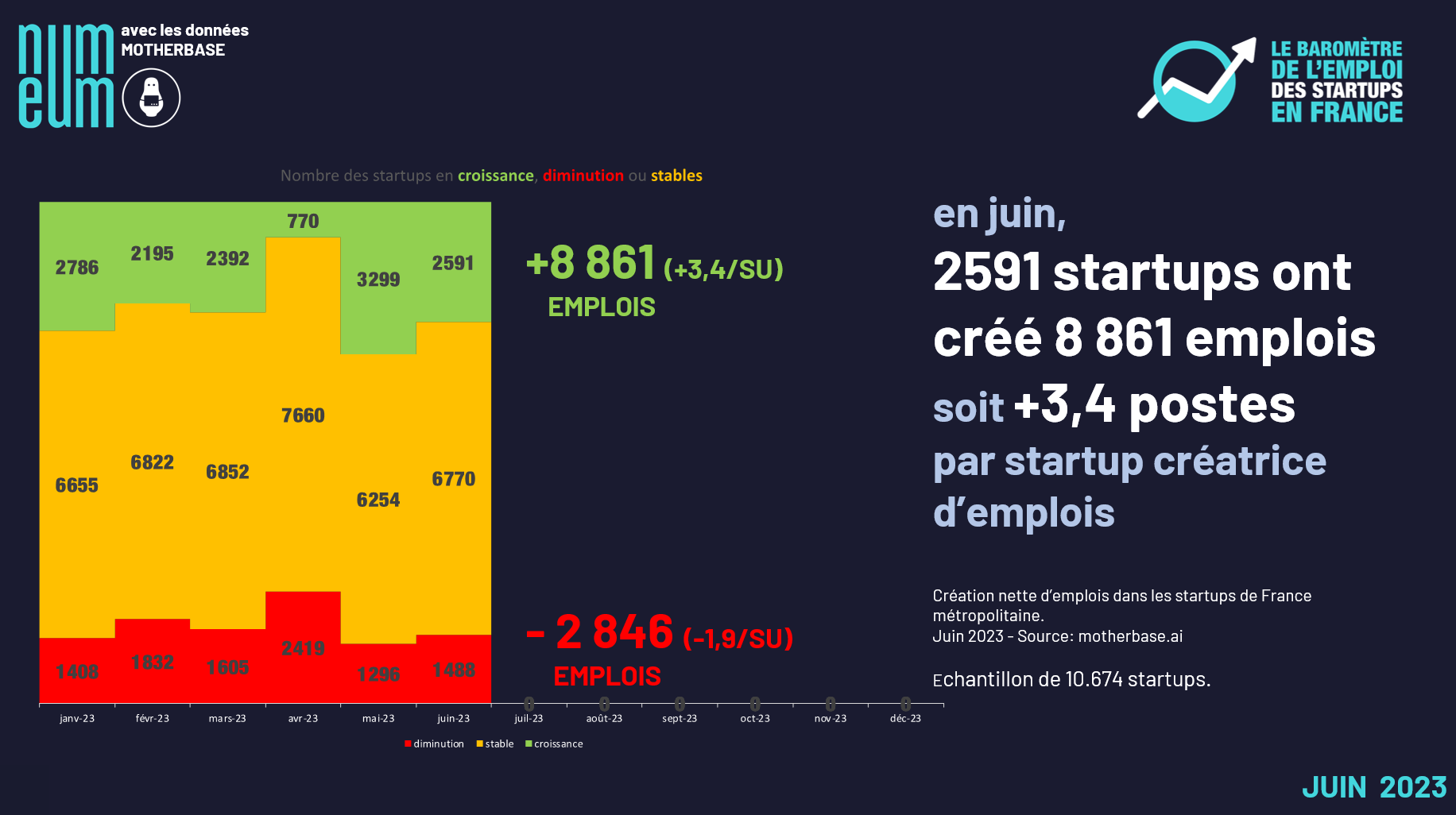

In the first six months of the year, French nuggets generated over 19,000 jobs (compared with 23,000 over the same period in 2022). Over this period, the employment dynamic grew by 7.2% (versus 10.1% over the same period in 2022). In other words, out of our sample of 10,674 French start-ups analyzed, they have created an average of 1.8 jobs over the last six months. Over the first half of 2022, they had created 2.2.

To put this data into perspective, out of our sample of 10674 startups: three quarters of startups created jobs (4541 startups) or stabilized jobs (3457 startups ), while a quarter (2676 startups) shed jobs in the first half of 2023.

Average headcount in French startups has risen by 3 jobs in one year

In 2023, only April saw a deterioration (almost 3,500 jobs lost), but the trend was followed by the two highest consecutive months of net job creation since the inception of our barometer. With over 287500 jobs counted in our sample of 10674 startups, we can deduce thatby June 30, 2023, the average French startup is made up of 27 employees (compared with 24 at the same time in 2022). In one year, French startups have therefore increased their average headcount by 3 additional recruitments.

Paris Region will account for 60% of startup jobs in France in 2023

Île-de-France and Auvergne-Rhône-Alpes account for the bulk of job creation in French startups.

The Île-de-France region has generated over 11,600 of the total 19,300 jobs created since January, representing 60% of the jobscreated by start-ups in France. Together with Auvergne-Rhône-Alpes, these two regions account for almost 70% of startup employment in France over the last six months.

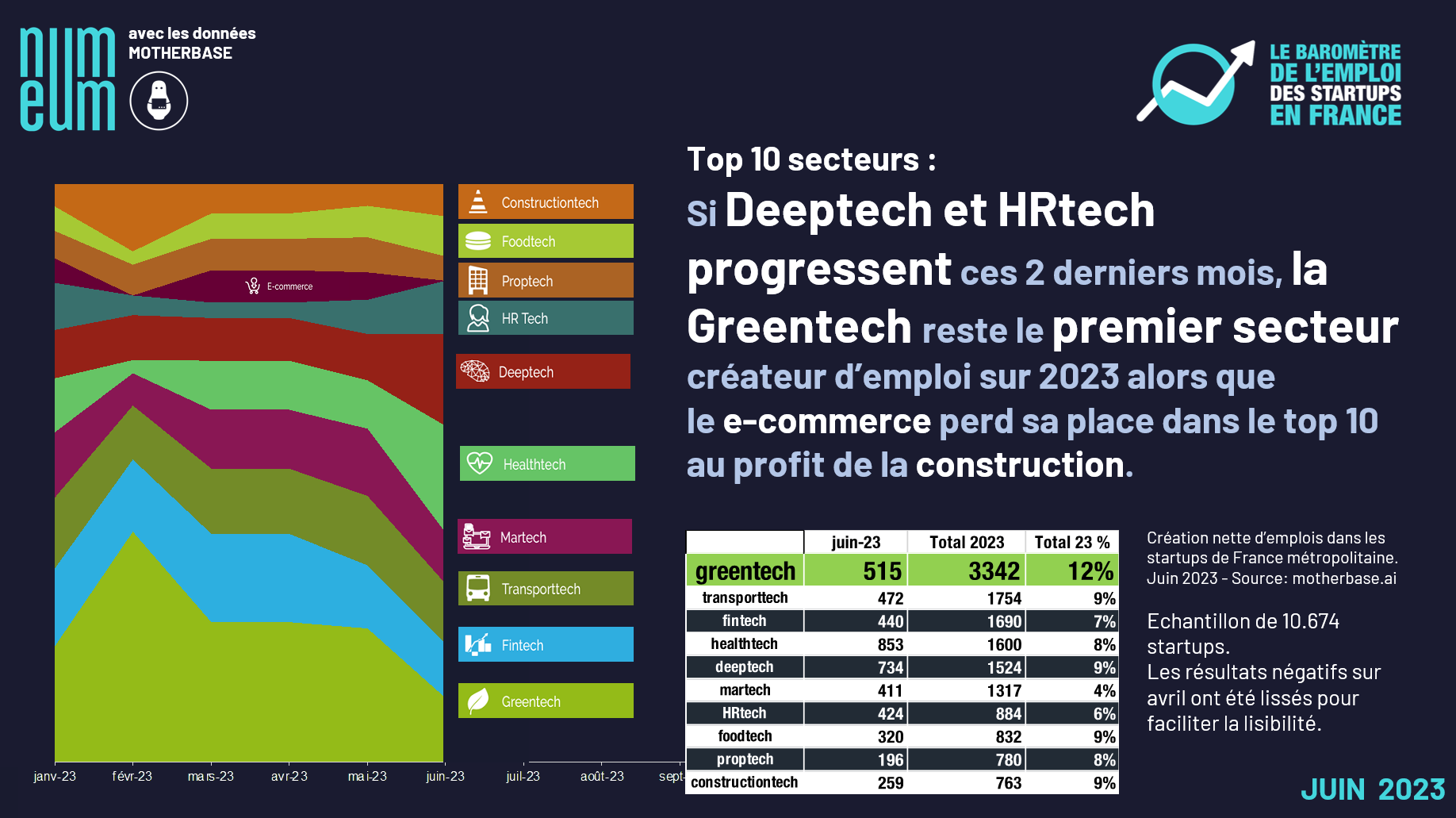

Greentech accounts for 17% of recruitment in French Tech startups in 2023

If there’s one sector that’s generating a lot of hiring in France, it’s Greentech. More than 3,300 jobs have been created since the first half of the year. Greentech accounts for 17% of all recruitment by French Tech startups. In other words, one in every six new hires in French Tech has been made by a Greentech startup since 2023. By way of comparison, Greentech had created over 4,300 jobs in the whole of 2022. The sector is therefore significantly strengthening its momentum in the first half of 2023.

Transporttech and Fintech are the other two sectors to complete the podium, with over 1,750 and almost 1,700 jobs created since January respectively. Deeptech has generated over 1,500 new hires since January. The sector had generated just over 1950 jobs by 2022. This sector will continue to grow in 2023. Finally, it should be noted that the e-commerce sector has slipped out of the Top 10 for the first time since January 2022, to the benefit of ConstructionTech.

Guillaume Buffet

Numeum

Director and Chairman of the Startup Commission

” The recurring dynamic of employment in startups in France is supported by sector-specific “waves” of innovative solutions. When one sector reaches a plateau, a new one takes over. This certainly goes some way to explaining the resilience of French tech employment in the current period. However, the strong momentum of Greentech seems to be more structuring and enduring: France is gradually establishing itself as one of the spearheads of solutions for ecological and climate change at European and international level. “

rn

In short, 2023 may not be as exceptional as 2022, but the signals seem to be green for our digital and French Tech companies.

Methodology

- Constant sample of 10674 French startups over the years 2022/2023 ;

- Monthly measurement of the number of employees (employee declarations) established by Motherbase in December 2022 (baseline) then every month in 2023 ;

- Cumulative results, by region, by department, by business sector;

- The Motherbase solution, on which Numeum bases its monthly barometer of jobs in French startups, includes not only digital startups, but also those from other sectors (biology, healthcare, industry, etc.).